Building Material Prices Set to Surge by Up to 10% in the Next Year!

CoreLogic analysis suggests that tariffs could push home construction costs up by 4% – 6% over the next 12 months as material costs adjust to the new landscape. In some cases, tariffs could push prices up by double-digit percentages.

The costs of building homes are about to get steeper, and it’s not just inflation. New tariffs could drive up material prices by 4%–6% within the next year, with some prices rising even more dramatically. This isn’t just a temporary blip; it’s a long-term trend that could push construction costs to new heights.

Developers are facing a serious challenge. No matter how they try to keep housing affordable, the math doesn’t add up. Tariffs proposed under the new administration are likely to make matters worse. Canadian lumber prices have already jumped 14.5%, concrete costs have surged by 8%, and household appliances could see price hikes of up to 20%.

Suddenly, the focus isn’t on how to build homes more cheaply; it’s whether it’s even possible to build affordable homes at all. Without an influx of new housing, the prices of existing homes will continue to soar, leaving many Americans struggling with housing affordability.

The key issue here is the potential for construction costs to rise even more due to tariffs, especially on goods from Canada, Mexico, and China. CoreLogic’s latest analysis shows that tariffs could add 4-6% to construction costs within the next year, and material prices could spike by as much as 10%. For builders, this isn’t just a cost increase—it could significantly delay projects and make homeownership less attainable for many.

With new home construction already averaging $422,000, any price hikes could add another $17,000–$22,000 to that figure. As Jay Thies from CoreLogic puts it, “Price surges are inevitable in this volatile climate.”

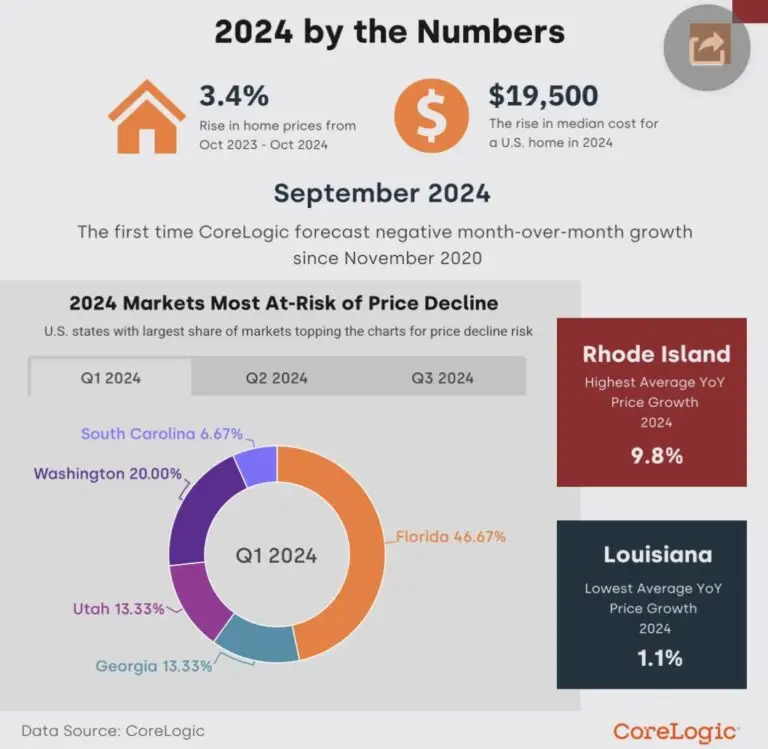

In 2024, the median price of a home in the U.S. climbed by $19,500, pushing it to an average of $385,000. This is still lower than the cost of new builds, but it’s becoming clear that for many Americans, neither option is within reach.

The U.S. Department of Housing and Urban Development defines a “cost-burdened” household as one that spends more than 30% of its income on housing. With the median U.S. income sitting at $48,060 in 2023, millions of Americans are being priced out of homeownership.

To make matters worse, tariffs on building materials are pushing homebuilders’ margins even tighter. Companies like D.R. Horton are trying to adapt by reducing home sizes or offering mortgage rate buy-downs, but it’s not enough. Despite these efforts, the cost of building a home has been steadily rising, and this is starting to affect builders’ profits.

In 2024, homebuilders saw their margins shrink to 11%, and even a small 4% increase in building costs, worsened by tariffs, could make affordable homebuilding almost impossible. With construction starts down 5.8% in 2024, the housing market is in a tough spot—and things aren’t looking much better.

A shift toward domestic material production, driven by tariffs, could alleviate some of the import-related costs. However, it comes with its own set of challenges. If demand for U.S.-made materials spikes, builders could face supply shortages and further price hikes.

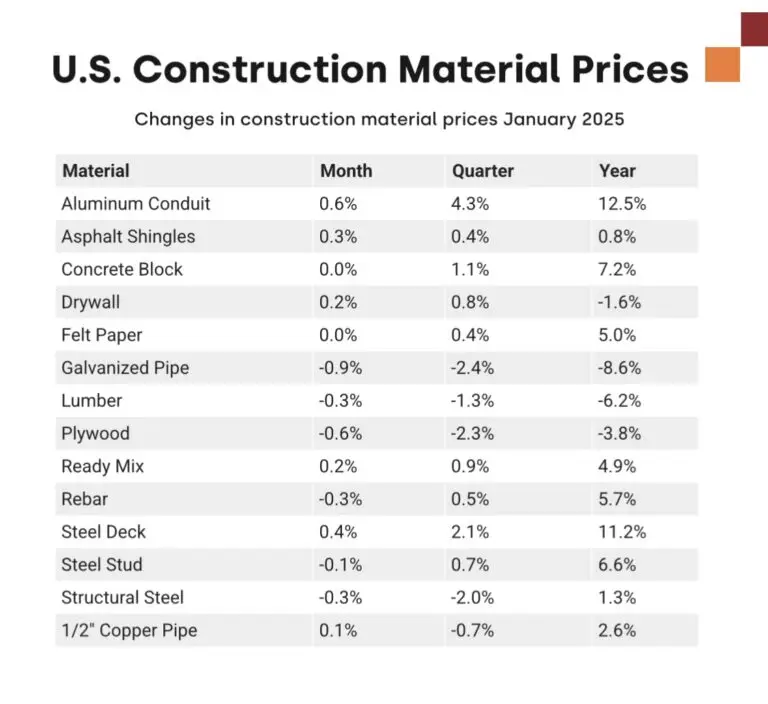

Lumber prices are already 4% higher than average, and if demand continues to rise, domestic production might not be able to keep up. In fact, the closure of sawmills and reduced lumber production over the last few years could lead to even more strain on the market.

Key materials like cement and concrete are also seeing price increases. James Hardie, a major supplier, raised concrete prices by 7% in early 2024 due to higher raw material costs. On the flip side, roofing materials, which are mostly made domestically, may stabilize or even decrease in price, thanks to the administration’s plans to boost domestic oil production.

However, natural disasters, like wildfires or hurricanes, could create short-term spikes in demand, further stretching resources and pushing prices even higher.

The recent wildfires in Los Angeles caused widespread destruction, with 20,000 properties damaged, and 60% expected to be total losses. This catastrophe is putting immense pressure on the already fragile construction supply chain. As a result, demand for materials for both rebuilding and new construction could spike, driving prices up by 10%-20% in the short term.

Lumber, for example, could see a significant price increase on top of what’s already high. After last year’s wildfires in Maui, concrete prices surged by 7%. While these price increases may stabilize over time, the tariffs could push costs even higher, making it harder for both homeowners and businesses to

Not all imports will feel the same tariff burden, but several key sectors are likely to see a major impact.

Canadian Wood Products: The U.S. uses a large amount of Canadian wood, and with tariffs on Canadian imports already rising, construction costs are on the rise. While domestic lumber sources are helping to fill the gap, prices remain high.

Chinese Steel: Proposed tariffs on Chinese steel could add significant costs to commercial projects, especially in areas like commercial construction, where steel is a primary material. This may make it harder to justify new projects.

Mexican and Canadian Concrete: Cement is another vital material in construction, and 25% of the U.S. supply comes from Canada and Mexico. Any increase in tariffs could directly affect commercial builds, driving up costs even more.

Household Fixtures: Fixtures like appliances, lighting, and cabinetry could see price hikes of 10%-20%, though their impact on the overall cost of building a home would be relatively minor. Even so, these increases will add up over time.

While some sectors, like roofing shingles and masonry, may see more stable pricing due to strong domestic supply, other materials are under intense pressure, and the consequences of tariffs could be far-reaching for builders and homeowners alike.

Orlando In The City

Minnesota & Florida

Dellwood Realty

763-516-6908

Minnesota 55121

I agree to be contacted by Your Dellwood Realty via call, email and text. To opt out, you can reply “stop” at any time or click the unsubscribe link in the emails. Message and data rates may apply.